Bitcoin, not crypto!

Bitcoin was created with a vision to have peer-to-peer digital money without any intermediaries. In 2008, Satoshi Nakomoto, who stays anonymous to this day, created Bitcoin using blockchain and cryptography technologies. How does Bitcoin work?

Central banks issue currency and the currency is transferred from person to person via intermediary banks that function as clearing houses for the transactions.

Bitcoin was created with a vision to have peer-to-peer digital money without any intermediaries. In 2008, Satoshi Nakomoto, who stays anonymous to this day, created Bitcoin using blockchain and cryptography technologies.

How does Bitcoin work?

In today's world, central banks issue currency and the currency is transferred from person to person via intermediary banks. The banks function as clearing houses for the transactions. So, a bank is needed for 2 individuals to transact with each other, unless the transaction amount is small, in which case, it can be settled in cash.

What does #Bitcoin not #crypto mean ?

Bitcoin came into existence in 2009 via a whitepaper that details the technology, mining process and economics behind Bitcoin. Satoshi Nakamoto, the anonymous inventor of Bitcoin mined the first few Bitcoins. It is essentially a cryptocurrency powered by Blockchain and Cryptography technologies. During the early days technology enthusiasts were the only ones mining Bitcoin and the coins were typically mined using laptops.

As more folks started mining Bitcoin, they started using it as a peer-to-peer form of payment. As Bitcoin started gaining popularity, the term 'cryptocurrency' was coined and other cryptocurrencies came into existence.

Today, there exists hundreds, if not thousands of cryptocurrencies.

The mainstream media has started to use the terms Bitcoin and crypto interchangeably. Bitcoin is cryptocurrency, but all cryptocurrencies are NOT the same as Bitcoin. It is important to understand this distinction and use the correct terminology in media and other messaging.

So, what is the difference between Bitcoin and other cryptocurrencies ?

The 2 defining, and key differences are :

- Tokenomics

- Decentralization

Tokenomics refers to the supply, demand and distribution of the cryptocurrency.

Bitcoin has a fixed maximum supply of 21M. New coins are added to the supply as and when they are mined. All of the 21M Bitcoins will be mined by year 2140.

Currently about 19.53M Bitcoins have been mined and are in circulation.

There is a 'halving event' that happens every 4 years and after each halving event, the mining reward is reduced by half.

New Bitcoins are mined in the form of rewards to miners, so essentially, the new coins added to the supply is reduced by half every 4 years.

So effectively, there can only ever be 21 Million Bitcoin. This makes Bitcoin a very rare asset whose value would increase as demand increases.

Decentralization simply means that there is no central person or entity controlling the asset. Bitcoin is a truly decentralized asset. Other blockchains and cryptocurrencies have organizations or individuals who hold the power to the crypto. They can for example, increase the supply, thereby decreasing its value. Security is another aspect that truly differentiates Bitcoin.

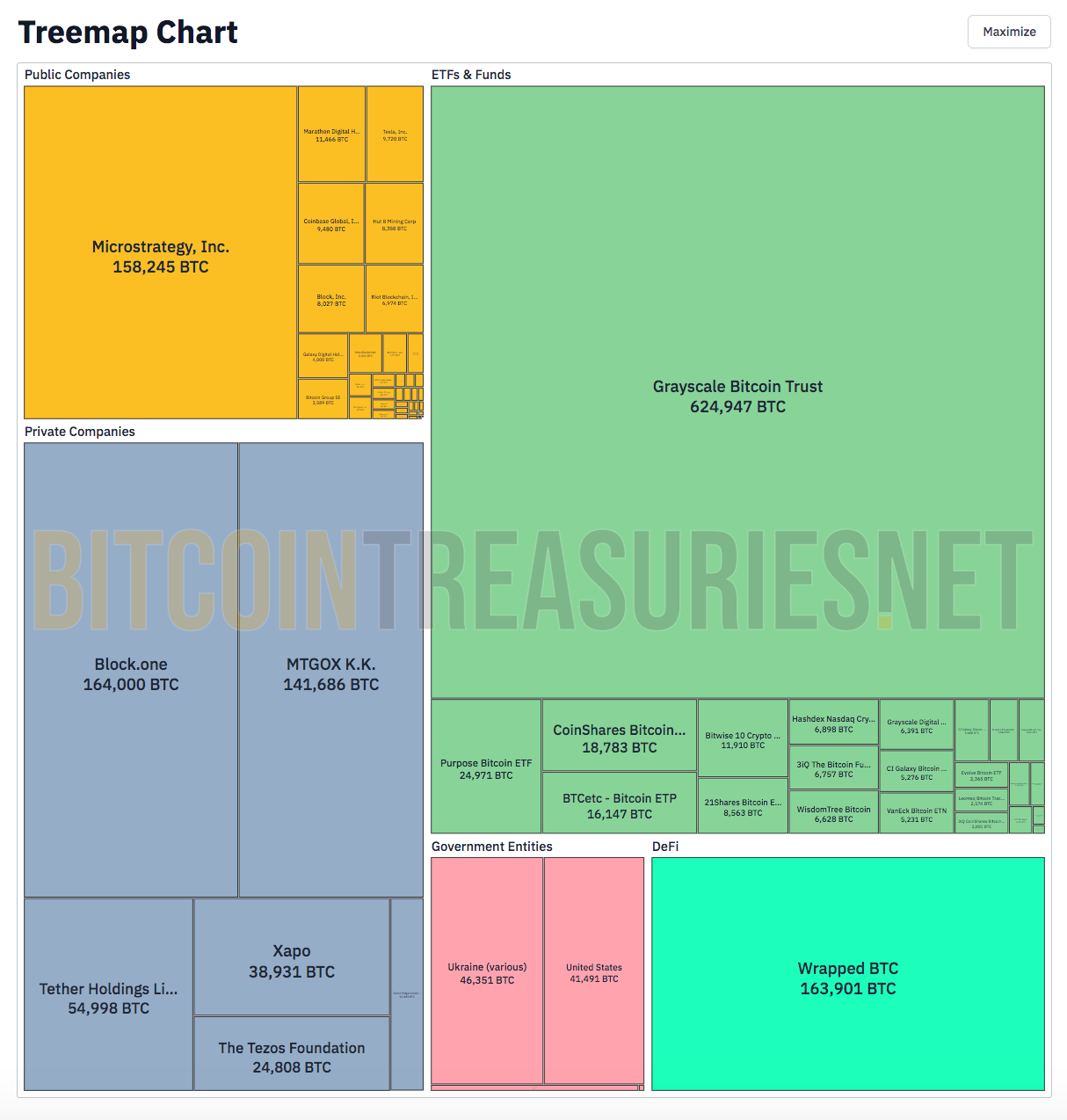

Here is a visual representation of Bitcoin holding from bitcointreasuries

In addition to the tokenomics and decentralization, security is another major feature of Bitcoin. The whitepaper and the code have been audited by the best of minds.

In contrast, it is quite easy to create a new cryptocurrency, the core technology and codebase is available for anyone to create their own. These currencies may and will have tokenomics that will work against retail holders, will not be decentralized and worse, can have voluntary and involuntary technical glitches.

For example, let's say, new cryptocurrency $piccco is released and the whitepaper lists the following :

i) Max supply - $1B

ii) Founders hold 40%

Since the founders hold 40%, they can vote in new rules that may effectively dilute retail holders.

For example they may vote to :

i) Increase total supply

ii) Give existing holders new benefits

Such things routines happen with other cryptocurrencies, and in its 14 years of existence, has never happened with Bitcoin.

In conclusion, if you're new to crypto, and you hear of a scam, it is important to understand: - Yes, there are several dangers associated with crypto - BUT, Bitcoin is different.